salt tax cap repeal 2021

It tends to help taxpayers. Caucuses are groups of lawmakers formed to to pursue common.

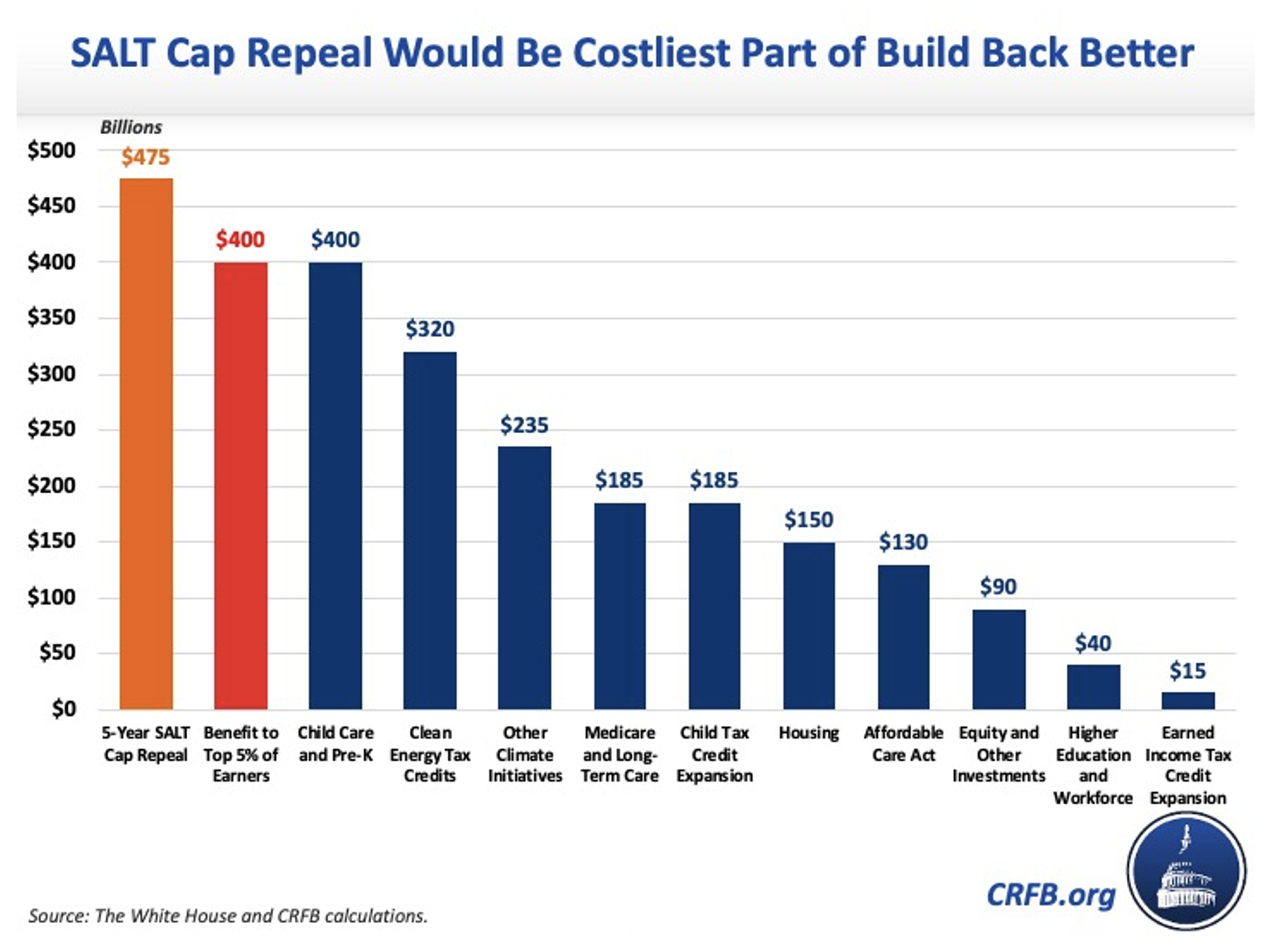

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Various proposals are under discussion in Congress this week.

. October 4 2021. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the tax foundation. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

That figure dropped to 21 billion in 2020. Republicans added the cap to reduce the cost of a tax package that gave more than 1 trillion in breaks to corporations and wealthy families while increasing the federal deficit. As alternatives to a.

A 10000 SALT Cap. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

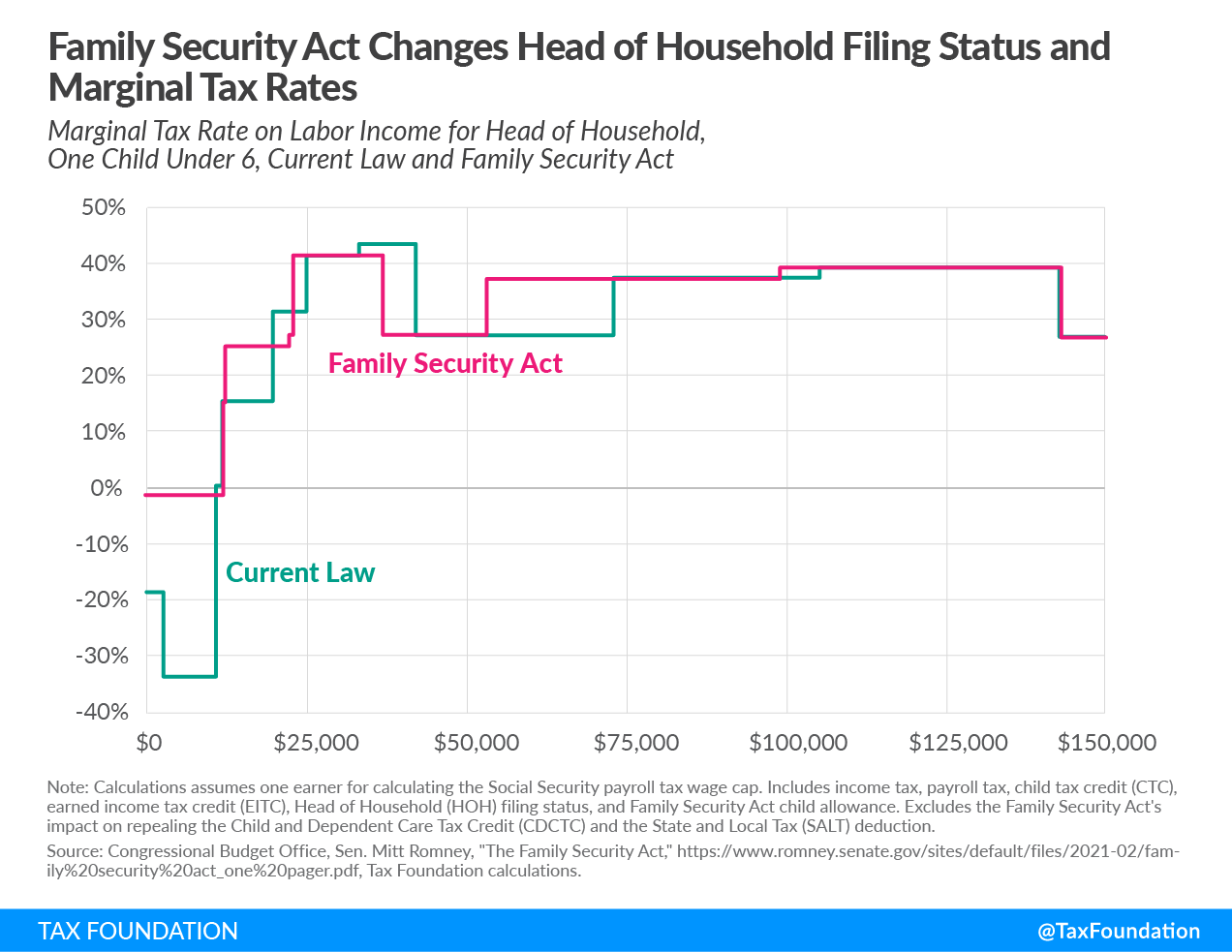

Agreed Upon Procedures AUP Employee. The top 1 of earners would see 57 of the benefits of a SALT repeal while the top 20 of earners would reap more than 96 of benefits according to the Tax Policy Center. Around 70 percent of the benefit from repealing the federal cap on state and local tax SALT deductions would go to households making 500000 or more per year while just 1.

Elrich says not so fast on SALT tax cap repeal. It would cost 887 billion to repeal the cap in 2021 an amount that could eat into Bidens other priorities. Contrast our proposal for a steady removal with the timeline of the SALT cap if Democrats decided on temporary full repeal.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. The Salt Deduction Cap Would Stay At 10000. Itemizers facing high marginal tax rates with high state and local taxes would see the greatest impacts.

Salt Tax Cap Repeal 2021. Democratic Senator Bob Menendez of New Jersey said repealing the 10000 cap on the federal deduction for state and local taxes for a few years could be a possibility as Congress wrestles. However nearly 20 states now offer a.

Josh Gottheimer D-NJ and Rep. The 10000 cap on state and local tax or SALT deductions imposed under the 2017 GOP-written tax overhaul is set to expire after 2025. Tom Suozzi D-NY pushed for the cap to be moved up to at least 75000 but.

By Ana Radelat November 4 2021 900 am. Repealing the SALT cap in 2021 would reduce federal income tax liability by. In the House members of the so-called SALT Caucus Rep.

Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the 10000 cap on. No SALT cap up to 2018. As policymakers weigh whether to lift or repeal the 10000 cap on state and local tax SALT deductions enacted by the Tax Cuts and Jobs Act.

Salt Tax Repealed By House Democrats The Washington Post

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Deduction Debate Could Change U S Politics Crain S Chicago Business

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Nj Representatives No Salt Cap Repeal No Budget Support

House Democrats Push For Salt Relief In Appropriations Bill

Salt Cap Relief Faces Setback Talley Co

House Votes For Increase And Partial Repeal Of Salt Cap Knowing It S Going Nowhere Don T Mess With Taxes

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Blue State Democrats Demand Salt Relief In Biden S Next Big Bill Politico

Law S Erik Jensen Weighs In On Salt Cap Repeal The Daily

Salt Cap Repeal Salt Deduction And Who Benefits From It

Cuomo Malliotakis And Other Officials Call On Congress To Repeal The State And Local Tax Salt Deduction Cap Silive Com

Aft On Twitter Repmikelevin The Salt Deduction Cap Was Built To Hurt The Middle And Working Classes And I Know That Common Sense Will Lead Us To Fix This Flaw In The

New York Seeks Supreme Court Review Of Salt Cap

Marc Goldwein On Twitter New Analysis Build Back Better Might Deliver A Net Tax Cut To The Rich In The First Two Years A New Budgethawks Analysis Shows Why Salt Cap